1) Determine who should receive Form 1099

Business owners need to determine who should receive a Form 1099. The Form 1099 will be issued to independent contractors and other parties. The IRS has rules to determine who is an employee and who is an independent contractor under the so-called Twenty Factor Test. For Connecticut employers; they should also look at the Connecticut ABC Test.

Some examples of independent contractors are:

- Attorneys

- Accountants

- Architects

- Bookkeeping Services

- Computer Maintenance

- Contractors

- Cleaning Services

2) Determine who you are required to give Form 1099 to

Form 1099- MISC needs to be issued to the following if they were paid more than $600:

* Individuals

*Partnerships

* Limited Liability Companies (“LLCs”)

Additionally, a 1099- MISC needs to be issued for all legal services, irrespective of the type of entity the law firm is.

3) Get IRS Form W-9 Completed

To properly complete Form 1099 you will need to secure Form W-9. This form will provide many of the details to complete the 1099. The person’s name, address and social security number (or federal Tax ID#) will be listed. This form is not forwarded to the IRS. Employers need to maintain this form on file.

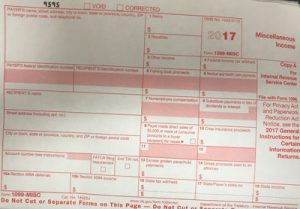

4) Issue Form 1099

January 31, 2018 is the deadline for filing the 2017 Form 1099- MISC. Form 1096 is the “cover sheet” summary you send to the IRS with a copy of the 1099’s. Failure to file these returns timely will result in penalties.